Medicare Penalty Calculator 2024. This practical device is more than just numbers and percentages—it’s your personal guide helping you. What is the medicare part d late enrollment penalty?

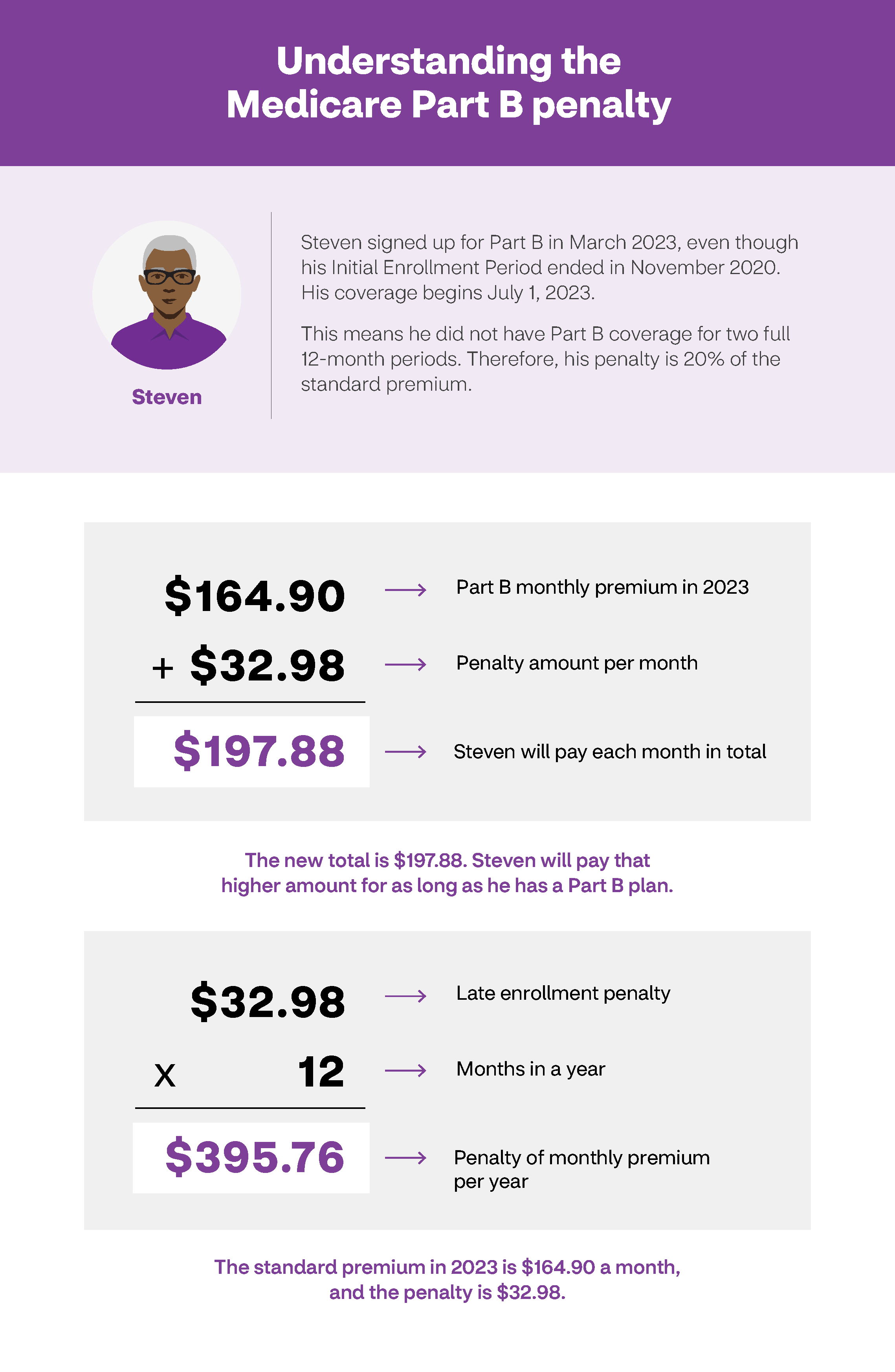

Medicare part b late enrollment penalty. A medicare late enrollment penalty (lep) is a fee you must pay if you did not sign up for medicare when you were first eligible.

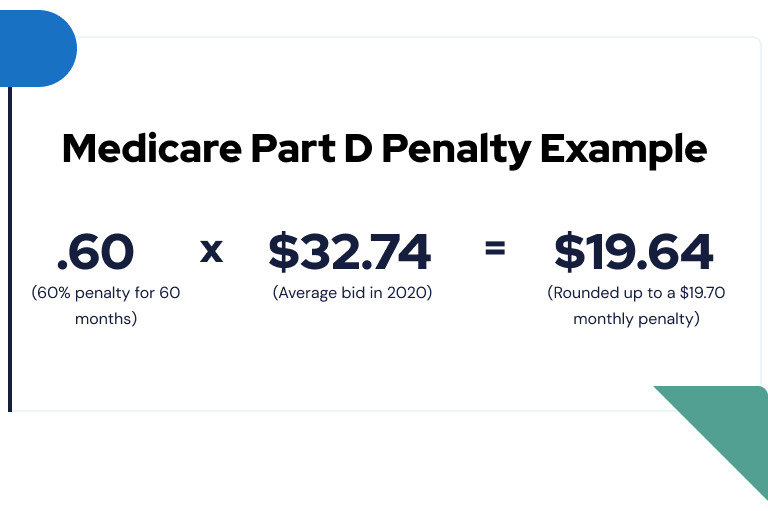

What Is The Medicare Part D Late Enrollment Penalty?

A medicare late enrollment penalty (lep) is a fee you must pay if you did not sign up for medicare when you were first eligible.

If You Don't See Your Situation, Contact Social.

Since the base part b premium in 2024 is $174.70, your monthly premium with the penalty will be $296.99 ($174.70 x 0.7 + $174.70).

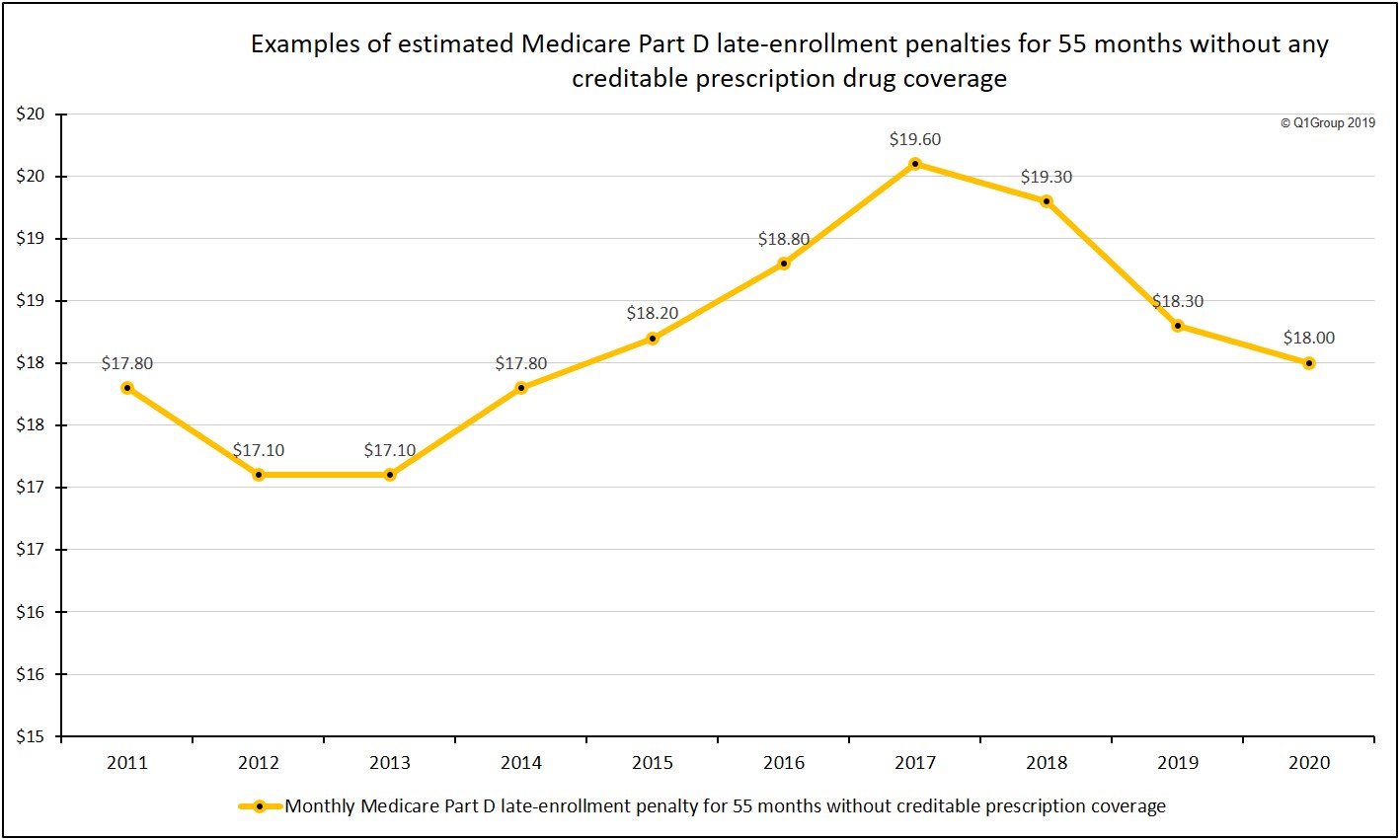

Here Is An Example Chart.

Images References :

Source: www.aetnamedicare.com

Source: www.aetnamedicare.com

How to avoid late enrollment penalties Aetna Medicare, The part b penalty is calculated by taking 10% of the monthly part b premium and multiplying it by the number of 12 months periods someone has gone without creditable. This coverage costs $164.90 a month in 2023 and $174.70 in 2024 for most people.

Source: legacyhealthinsurance.com

Source: legacyhealthinsurance.com

How To Calculate & Avoid Medicare Late Enrollment Penalties Legacy, Use this calculator to determine your penalty for going without creditable prescription drug coverage. What is the medicare part d late enrollment penalty?

Source: www.medicarefaq.com

Source: www.medicarefaq.com

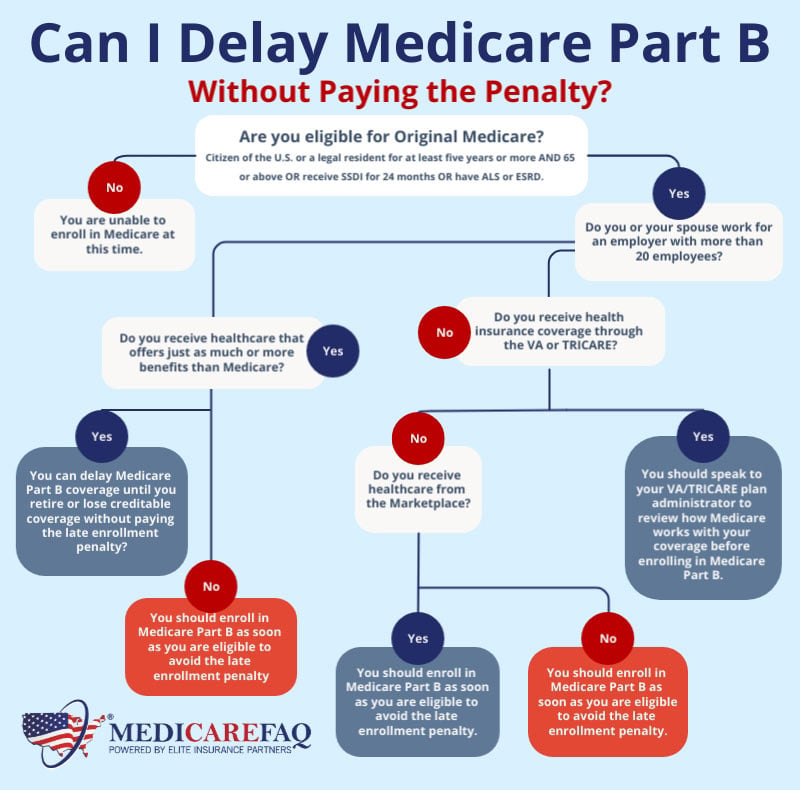

Medicare Part B Late Enrollment Penalty How to Avoid It MedicareFAQ, $174.70 (2024 part b standard premium) + $34.94 (20% [of $174.70] late enrollment penalty) $209.60 will be your part b monthly premium for 2024. On october 12, 2023, the centers for medicare & medicaid services (cms) released the 2024 premiums, deductibles, and coinsurance amounts for the medicare part a and.

Source: www.healthforcalifornia.com

Source: www.healthforcalifornia.com

Medicare Prescription Drug Coverage (Part D) Health for California, Although your part b premium amount. Estimated monthly penalty for 2024.

Source: www.medicaretalk.net

Source: www.medicaretalk.net

How To Appeal Medicare Part B Late Enrollment Penalty, If you are assessed this penalty, you will pay it every month for as long as you have medicare. Is there a medicare part d penalty under 65?

Source: www.aetnamedicare.com

Source: www.aetnamedicare.com

How to avoid late enrollment penalties Aetna Medicare, This coverage costs $164.90 a month in 2023 and $174.70 in 2024 for most people. Use this calculator to determine your penalty for going without creditable prescription drug coverage.

Source: medicare-faqs.com

Source: medicare-faqs.com

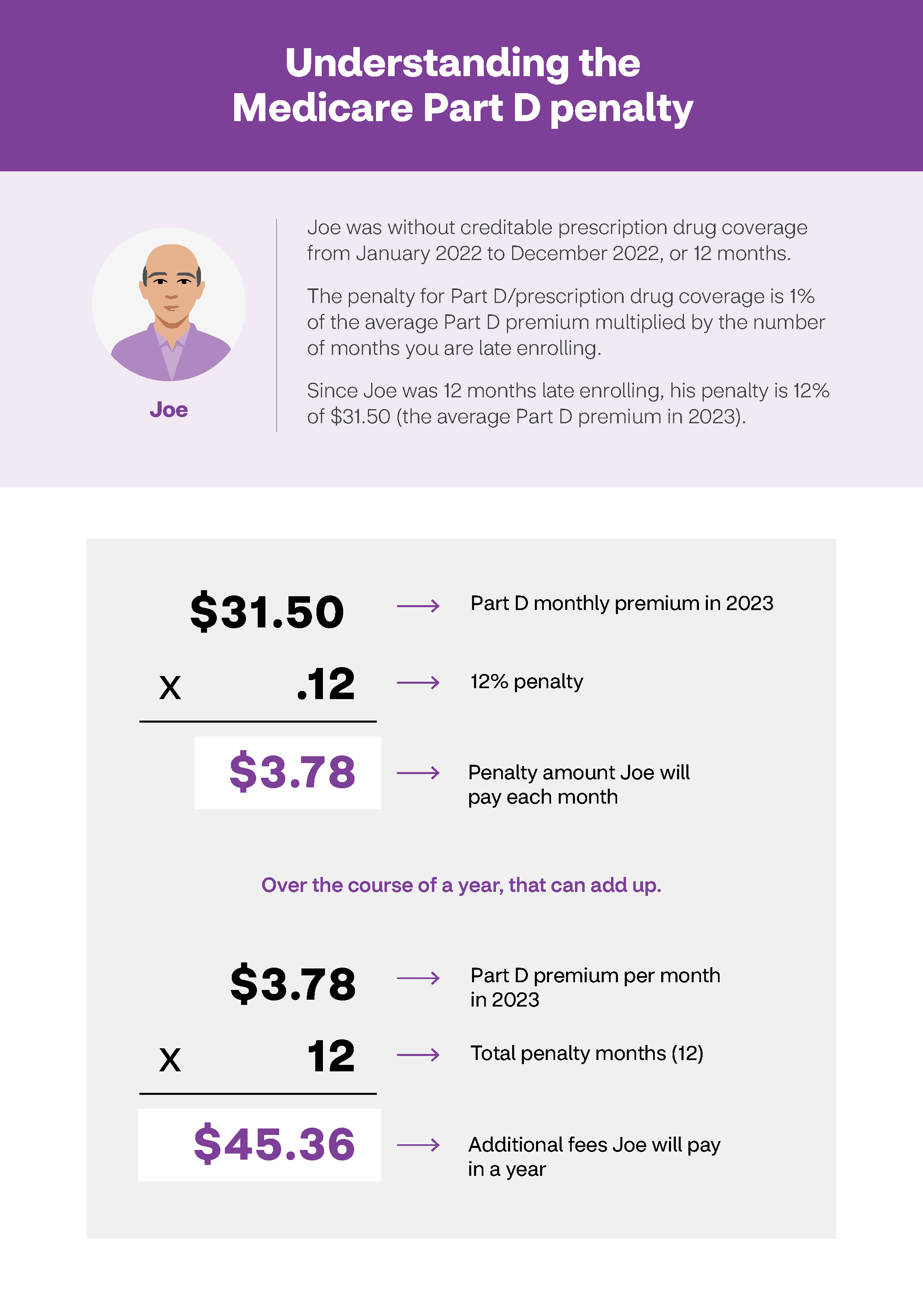

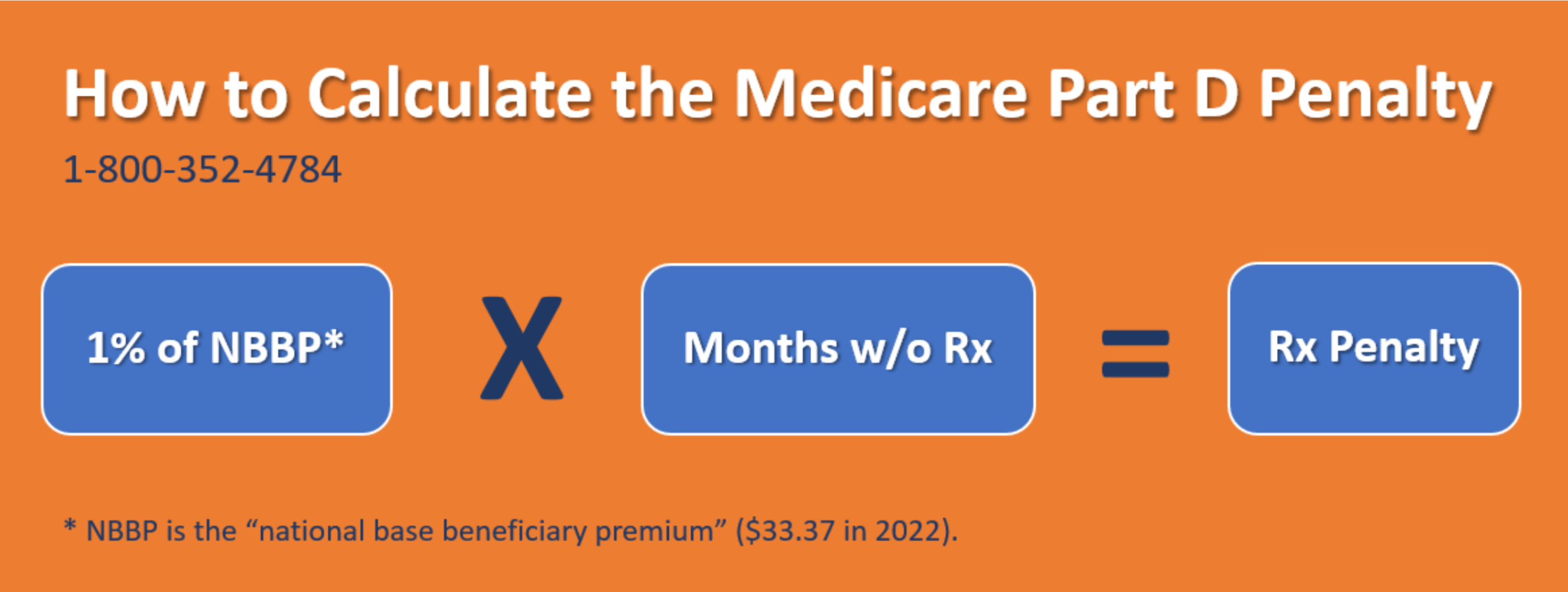

How To Calculate The Medicare Part D Penalty, The irmaa income brackets for 2023 start at $97,000 ($103,000 in 2024) for a single person and $194,000. Is there a medicare part d penalty under 65?

Source: www.aetnamedicare.com

Source: www.aetnamedicare.com

How to avoid late enrollment penalties Aetna Medicare, Medicare part d late enrollment penalty. Some people delay signing up for part b if they have.

Source: www.nextgen-wealth.com

Source: www.nextgen-wealth.com

Related Monthly Adjustment Amounts (IRMAA) and Medicare Premiums, A medicare part b penalty calculator is a valuable tool for individuals who are enrolled in or planning to enroll in medicare. Use this calculator to determine your penalty for going without creditable prescription drug coverage.

Source: medicare-faqs.com

Source: medicare-faqs.com

How To Calculate The Medicare Part D Penalty, A medicare late enrollment penalty (lep) is a fee you must pay if you did not sign up for medicare when you were first eligible. You’ll start to owe a late enrollment penalty if you go at least 63 days without sufficient prescription drug coverage after the end of your initial medicare enrollment.

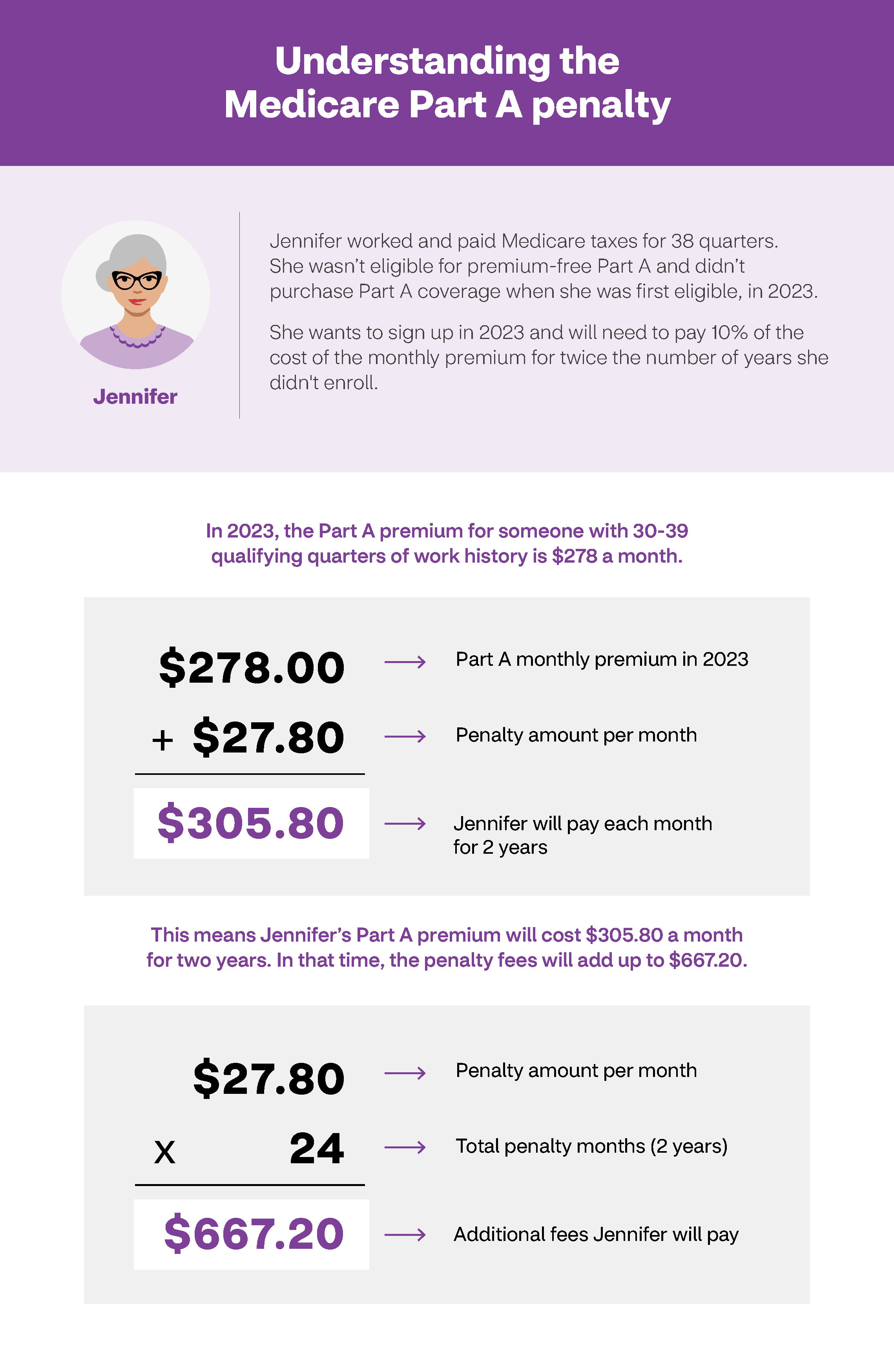

Medicare Part A Penalty Calculator.

On october 12, 2023, the centers for medicare & medicaid services (cms) released the 2024 premiums, deductibles, and coinsurance amounts for the medicare part a and.

Medicare Part D Late Enrollment Penalty.

Calculate your medicare part a late enrollment penalty.